top of page

Search

Whose money is it anyway?

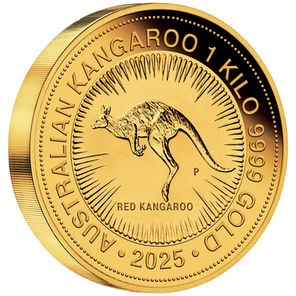

This blog is about sound money. It discusses deficit spending, inflation, interest rates, central banks, and whether gold may soon replace the US$ as the world’s reserve currency. It proposes that we would be more prosperous if we were free to choose our preferred currency, and borrowers and lenders were free to set their own interest rates.

Sound money is essential for our liberty and our economic well-being.

Peter Francis Fenwick

6 days ago6 min read

Printing Money does not Create Wealth

Is it possible to create prosperity by printing money? Have the Central Banks found the answer to the Philosopher's Stone? On Tuesday, 1st October 2019, the Reserve Bank of Australia cut the cash rate to 0.75% in order to stimulate the economy. The objective was to reduce the unemployment rate to 4.5% and to increase wages. Over dinner that night, my daughter Kate quizzed me and Frank about how that worked. It turns out that it is not as obvious as Dr. Lowe suggests

Loretta Lockesmith

Oct 17, 20195 min read

Let the Market Set Interest Rates

We are pleased when the Reserve Bank keeps interest rates on hold at their low, low levels. For we know that low interest rates encourage...

Peter Francis Fenwick

Sep 24, 20153 min read

A Petition on Behalf of the Greek People

I exhort the politicians and bureaucrats of Europe to think again, to do better. The proposed Greek bailout entails too much intervention...

Peter Francis Fenwick

Jul 14, 20152 min read

Money Doesn't Grow on Trees

My mother's generation understood the virtue of thrift, and they knew the importance of saving and investment.

Peter Francis Fenwick

Jun 15, 20152 min read

bottom of page